How “Opportunity Funds” are bringing investment to low-income areas

On Dec. 22, 2017, the Tax Cuts + Jobs Act was signed into law, having passed through the House (227-203) + the Senate (51-48).

One of its lesser-known elements, the Investing in Opportunity Act, looks to bolster distressed areas by offering wealthy investors the chance to erase their tax obligations. (The policy was developed from the founder of Napster, and original Facebook president Sean Parker’s think tank– the Economic Innovation Group, + is championed by Senator Tim Scott).

But how? By investing in a qualified “Opportunity Fund.” O Funds act as investment vehicles, driving needed cash flow into distressed communities. The O Funds activate passive holdings by connecting investors to investment opportunities in “Opportunity Zones.” A community development program, O-zones are low-income areas that are designated by each state based on particular criteria. To receive tax relief, investors may choose to push their realized capital gains into projects or companies within these domestic emerging markets.

The first set of Opportunity Zones, covering 18 states, were designated on April 9.

Downtown Columbia/West Cola has at least 6 approved O-zones (more or less, depending on where you draw the metro lines):

- Tract #45079000700 (Elmwood/Earlewood, Cottontown, BullStreet)

- Tract #45079000500 (Colonial Heights, 277, Colonial Dr.)

- Tract #45079000200 (Eau Claire, North Main)

- Tract #45063020509 (Saluda Gardens, N. Lucas St., Mohawk Dr.)

- Tract #45063020300 (Brookland, State St., B/C/D/E/F Ave.s, Meeting St., Jarvis Klapman Blvd.)

- Tract #45063020201 (Brookland Cayce High School, I/J/K/L/M/N/O Ave.s, State St., 12th St.)

...and many more in further-out areas of Richland + Lexington Counties.

Columbia area O-zones | Map via South Carolina Opportunity Zones

So, how exactly do Opportunity Funds provide enough tax cut breaks to encourage investors to put their money into communities they would otherwise overlook? Where are the O-zones across the state, and in the nation?

How Opportunity Funds work

- Investors who sell assets have 180 days to plow their taxable capital gains into an approved opportunity fund

- The fund must hold 90% of its assets in an O-zone located project

- The investor themselves do not need to live in the area

- Taxes on the original reinvested gain are not due until Dec. 31, 2026, with the taxable gain being cut by 15%

- The new opportunity investment grows tax-free (like a Roth IRA) as long as it is held for at least ten years

- A five-year holding increases the rolled-over capital gains basis by 10%

- A seven-year holding increases the rolled-over capital gain investment basis 5%, for a total of 15%

No limits on:

- The amount you can put in

- How much tax you can avoid

- The type of tax (whether federal, state, or local) you can avoid

- How long the proceeds of the reinvested gains can compound tax-free

How Opportunity Zones are selected

To qualify as an Opportunity Zone, the area must meet the following criteria:

- Poverty rate of 20% or higher

- Or a median household income that is less than 80% of the surrounding area

Once the areas have been determined, only 25% of a state’s total tracts are allowed to be designated by Governors as eligible O-zones.

What are considered O-zone projects?

O-zone projects can be farming spaces, mining, energy, data centers, labs, real estate, startups + venture funds. Each zone may push certain projects based on the needs of the area (i.e. rural vs. city). For example, for real estate developers, building in an O-zone area offers cheap real estate as well as an unlimited, untaxed upside if the neighborhood continues to grow.

As each O-zone is designated by the area’s mayor, most work to ensure the projects selected are built + serviced by locals, with the town adopting + enforcing zoning and affordable-housing laws as the new cash begins to flow into the community.

The Treasury + the IRS are scheduled to hand down the final rules for Opportunity Zones by the end of this year, with investments being able to start in early 2019.

Where does South Carolina stand?

- Total Tracts: 1,097

- Eligible, low-income community tracts: 538

- Number of tracts approved: 135 (the maximum 25% allowance)

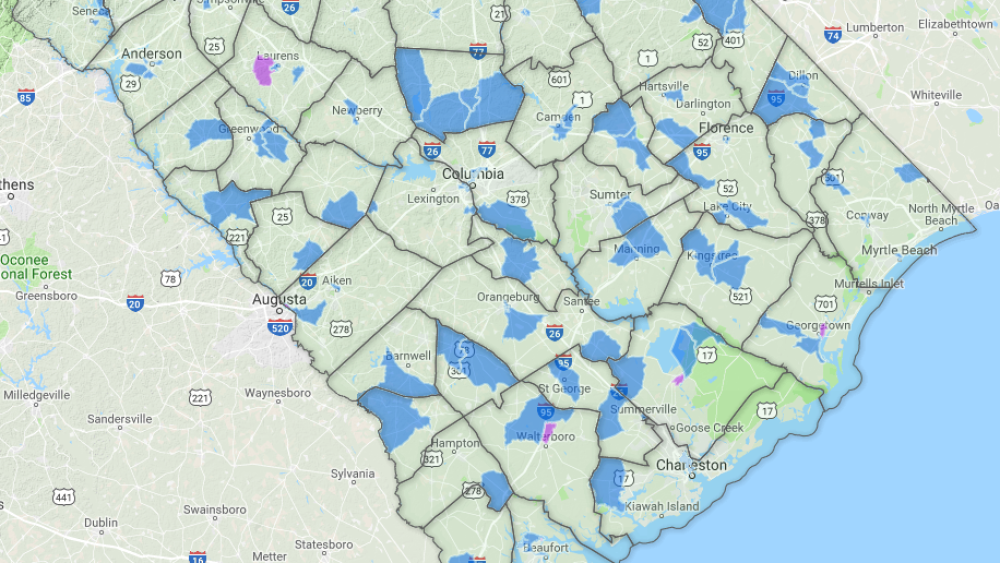

Here is a map of the state, showing the tract breakdown. ⬇

South Carolina tracts | Map via South Carolina Opportunity Zones

What does SC hope to accomplish through the Investing in Opportunity Act?

The state’s primary areas of focus for the policy are:

- Promoting economic vitality to parts of the state that have not shared in the general prosperity over the past few years

- Funding the development of workforce and affordable housing in areas with escalating prices + inventory shortages

- Funding new infrastructure to support population + economic growth

- Investing in startup businesses who have the potential for rapid increases in scale

- Upgrading the capability of existing underutilized assets through capital improvement investments

While investments will most likely not occur until the first quarter of 2019, what types of O-zone projects would you like to see?

Let me know in the comments below.